Navigating title issues and claims during property transactions can be a complex process. Fortunately, title insurance agencies specialize in resolving these challenges, providing invaluable assistance. In this in-depth blog post, we will explore the critical role of title insurance agencies in identifying and resolving title issues and claims, ensuring a smooth and secure property ownership journey.

Understanding Title Issues and Their Significance

Title issues encompass a wide array of problems that can arise within the legal ownership of a property. These may include errors in public records, undisclosed liens, encroachments, boundary disputes, and unresolved claims from previous owners. Resolving these title issues and claims is paramount to ensure a clean and marketable title, granting peace of mind to both buyers and lenders.

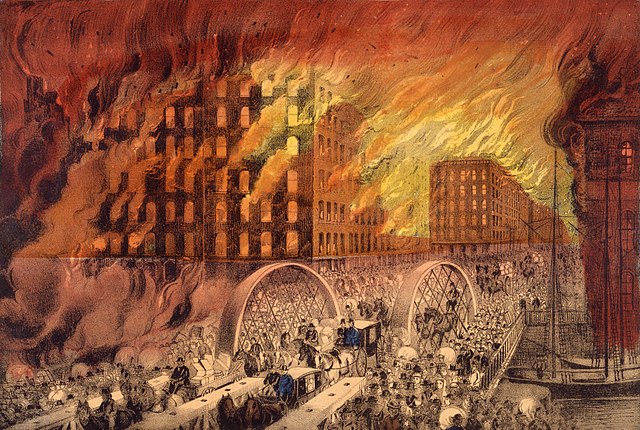

The Consequences of Ignoring Title Issues

Failure to address title issues can have far-reaching consequences for property buyers. Without proper resolution, buyers may face financial risks, lengthy legal disputes, or even the loss of their investment altogether. Additionally, lenders require a clear title to minimize their risk exposure before approving mortgages. Effectively resolving title issues is a crucial step in protecting the interests of all parties involved in a property transaction.

The Role of a Title Insurance Agency

Title insurance agencies play an indispensable role in facilitating the resolution of title issues and claims. Let’s delve into the ways they assist property buyers throughout the process:

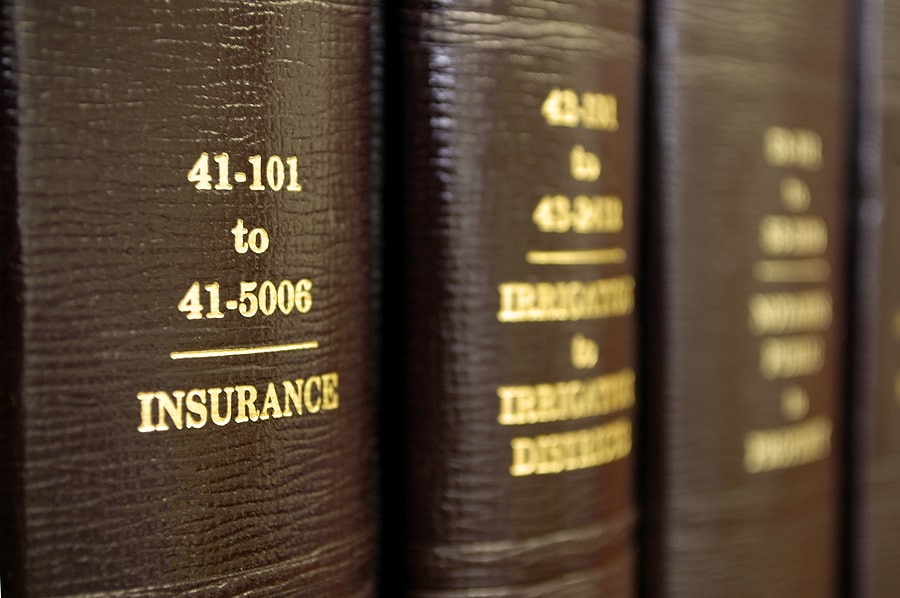

a) Comprehensive Title Search

When purchasing a property, title insurance agencies conduct meticulous title searches. These searches involve extensive reviews of public records, ensuring all risks and potential title issues are thoroughly identified.

b) Thorough Issue Investigation

Upon discovering any potential problems during the title search, title insurance agencies delve deeper to investigate the issues at hand. They collect and analyze relevant documents, examine past transactions, and consult legal experts to evaluate the validity of claims or liens against the property. This meticulous investigation ensures a detailed understanding of the complexities involved, aiding in effective resolution.

c) Dedicated Issue Resolution

After identifying title issues, title insurance agencies leverage their expertise to resolve them efficiently. This may involve negotiating with claimants, addressing errors in public records, facilitating legal remedies, or providing financial compensation to protect the buyer’s interests. Their commitment to resolving these issues expeditiously helps buyers proceed with their property transactions confidently.

d) Safeguarding Through Title Insurance

Once title issues are successfully resolved, title insurance agencies provide an essential layer of protection through title insurance policies. These policies offer financial protection to buyers and lenders against any future claims or defects that may arise. This added security ensures the long-term integrity of property ownership.

The Remarkable Benefits of Title Insurance

Title insurance offers a multitude of advantages that extend beyond issue resolution. Let’s explore some key benefits:

a) Peace of Mind

Title insurance provides peace of mind to property owners, safeguarding their investment against unforeseen financial losses resulting from undiscovered title defects. This assurance empowers buyers to confidently take ownership of their properties.

b) Cost-Effective Protection

Compared to the potential expenses arising from legal battles or property loss, the investment in title insurance is remarkably cost-effective. By paying a one-time premium, buyers receive coverage that lasts as long as they own the property, protecting them from future claims or disputes.

c) Lender Protection

In addition to protecting buyers, title insurance also benefits lenders. By minimizing risk exposure, lenders gain the confidence to offer mortgages, ensuring smoother financing and facilitating property transactions.

Navigating title issues and claims is an integral part of any property transaction. The role of title insurance agencies in resolving these challenges cannot be overstated. Their expertise in conducting comprehensive title searches, investigating issues diligently, facilitating resolutions, and providing the safeguard of title insurance empowers buyers to make informed decisions and protects their property rights. By acknowledging the significance of addressing title issues and leveraging the expertise of title insurance agencies, property buyers can embark on their ownership journeys with confidence and security.