Title insurance is a crucial aspect of the real estate process in the United States. Regarding protecting the rights and interests of homeowners and lenders, title insurance plays a vital role. This article explores the importance of title insurance, why someone needs it, and how to choose a good title insurance company.

Title Insurance Provides Protection

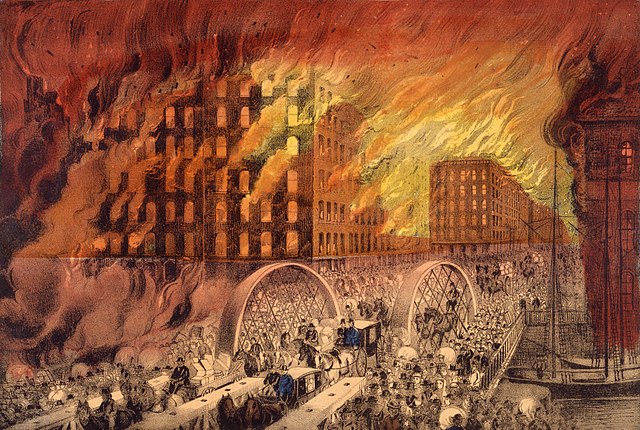

Title insurance is important in the United States for several reasons. Firstly, it provides protection against potential financial loss due to defects in the title of a property. These defects can include errors in public records, undisclosed heirs claiming ownership, and fraudulent deeds. Without title insurance, homeowners and lenders could be at risk of losing their investment in the property.

Title Insurance Covers Defects

Additionally, title insurance covers unknown title defects that may arise after the purchase of the property, giving homeowners peace of mind and security in their investment. Furthermore, title insurance provides assurance of legal ownership, ensuring that the property has a clean title and is free from any legal claims or disputes. This is essential for both homeowners and lenders to have confidence in the property’s ownership status.

Ultimately, title insurance is important in the United States because it is often required by mortgage lenders as a condition for loan approval, making it a necessary component of the real estate transaction process.

Why Do You Need Title Insurance?

So, why does someone need to have title insurance? The answer lies in the protection it offers against unforeseen claims or legal issues that may arise in the future. Without title insurance, homeowners and lenders could be vulnerable to potential financial loss and legal battles related to the property’s title. In the event of a title defect, having title insurance acts as a safety net, providing coverage for the costs associated with defending the title and any potential loss in the property’s value.

Additionally, title insurance is often required by most mortgage lenders as a means of protecting their investment in the property. Even if it is not a requirement, having title insurance can provide homeowners with coverage for any previous ownership issues that may surface after the purchase of the property.

Ultimately, having title insurance is essential for avoiding potential legal and financial repercussions related to the property’s title.

How Do You Choose a Good Title Company?

When choosing a good title insurance company, there are several factors to consider.

Firstly, it is important to research the company’s reputation and track record in the industry. Look for a title insurance company with a strong reputation for providing reliable and comprehensive coverage.

Additionally, consider the company’s experience and expertise in the field of title insurance. A company with a long-standing history and deep knowledge of the industry is likely to offer better service and coverage.

Furthermore, check for the financial stability and underwriting capabilities of the title insurance company. This is crucial in ensuring that the company has the resources to fulfill its obligations in the event of a claim.

When comparing different title insurance companies, it is important to evaluate the quotes and coverage options they provide. Look for a company that offers competitive rates and comprehensive coverage to meet your specific needs.

Lastly, consider the level of customer service and claims processing offered by the title insurance company. A responsive, efficient, and transparent company handling claims will provide homeowners and lenders with the support they need.